Umbrella Payroll

About The Project

Jays Group are an accountants and payroll services company based in Sheffield, England. They specialise in providing their services to agency umbrella contractors and limited companies working in the manufacturing and supply chain industries.

Following a change to the law with regards to IR35, many self-employed contractors working through limited companies will be reconsidered as employees and forced to move to PAYE schemes paid out under umbrella companies.

Jays Group took the opportunity to prepare for the change which would see a large number of their clients switching to umbrella company payments, as well as presenting a fantastic opportunity to expand their client base. They wanted to move their manual process to an automated one, and couldn’t find a suitable system for a price they were willing to pay.

The Solution

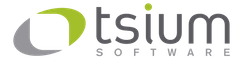

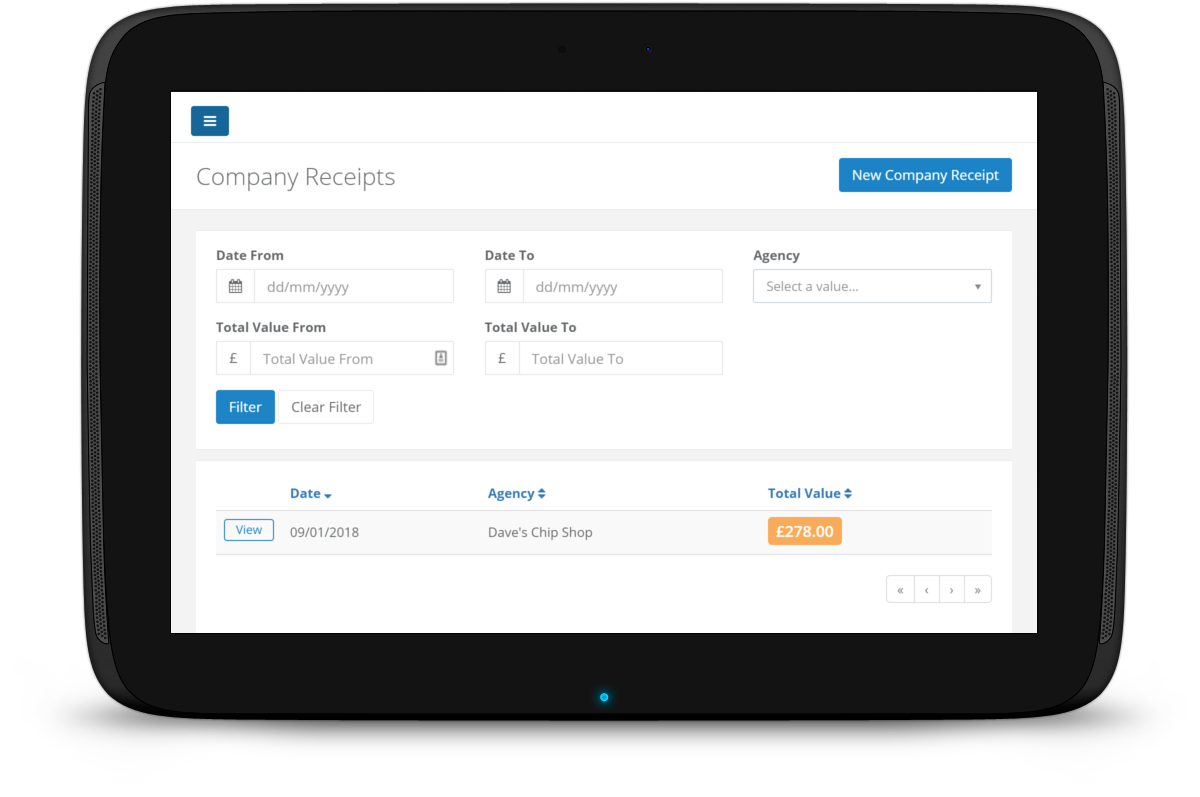

tsium developed an umbrella company payment administration system for Jays Group which they use to pay employees of the umbrella companies that they manage.

The system allows the payment data received from agencies to be loaded into the system and associated with their clients. Clients can have multiple payments from different agencies coming in on an ad-hoc basis, and the system allows payments to be grouped together in weekly and monthly payment cycles.

It accurately calculates tax and national insurance payments for both the employer and employee, handles deductions such as student loans and expenses, and maximises the employees take home pay. It also generates payslips which it emails to the clients and sends additional SMS messages once they have been paid.

It is fully configurable to allow for changes in national insurance and taxation rules.

Key Outcomes

Technologies

- It is built in ASP.NET MVC and runs off of a SQL Server database.

- It uses JQuery and Bootstrap to provide a rich user experience.

- It integrates into SendGrid and MessageBird for email and SMS delivery.

Highlights

- It adheres fully to all HMRC taxation rules.

- It is fully configurable to allow for all types of changes to taxation banding.

- It accurately calculates employer and employee tax and national insurance.

- It takes into account student loan payments and expenses.

- It generates PDF payslips and sends these to clients via email.

Duration

- 3 months.

Get In Touch

If there’s anything you want to discuss with us, drop us a message, and one of our consultants will get back in touch to arrange a call.